Why?

The tech-tilted NASDAQ has risen +20% since mid-June.

Still materially down on the year, but a 20% rise over seven weeks is both significant in the size of the advance and duration.

Other markets, which were not down as much, have also risen nicely:

- S&P +14%

- TSX +8

- Europe +11%

- Japan +10%

- Canadian bonds +5%

- US bonds +4%

- US high yield +5%

- US long bonds +8%

This market recovery has given rise to many questions. Is the bottom in? Is this merely a bear market rally? Or even more simply,

why?

"Why" does sum up the apparent demand for some reason to explain this recent market advance, given the rather negative headline news flow. U.S. consumer prices surprised to the upside, so inflation ain't going down yet. Of the 25 major central banks, 19 raised rates in the past few weeks, including a 100bps move by the Bank of Canada. The U.S. posted a second consecutive quarter of negative GDP growth, often coined as a recession (unofficially). Let's add a continued war in Ukraine, pending energy issues in Europe, and some material posturing around Taiwan. The news is not good. So why is the market so happy?

Even more impactful have likely been the quants, hedge funds, or whoever you want to bucket in the fast money category. The fact is the number of bearish bets against the broader market reached negative extremes last seen in market troughs. The chart below shows non-commercial or speculative futures and options positions on the S&P. The official data is delayed by a couple of weeks, but anecdotal data points to these negative bets being closed over the past few weeks. That puts upward buying pressure on the market, which certainly helps. As managers of a quant strategy, we are part of this mix, having increased our equity weighting from 36% in mid-June to over 50% by mid-July and now almost 70%.

The quants and fast money will not be able to make this a sustainable rally. For that, you need broader inflows which have remained relatively muted over the past month. This could change as positive performance is a strong lure for many, but there's limited evidence at this point. However, this positive will likely prove fleeting.

Earnings – It is funny, and we are partly laughing at ourselves, that everyone was all down on this earnings season. Estimates had remained elevated and really had not seen many downward revisions despite slowing economic growth, continued cost pressures, labour shortages, currency gyrations, etc. This may have been the most common comment among strategists that earning estimates were still too high and had to come down. But once again, earnings season went pretty well and certainly didn’t disappoint.

But don’t get too excited. First, this is very backward-looking as it was Q2 which ran from April to June. And corporations, being optimistic about their future, will keep guidance as long as possible before disappointing the market. Make no mistake, the economy is slowing, costs are still elevated, and earnings and margins are still at risk. This positive reaction to the Q2 earnings season will likely prove fleeting.

Inflation & Fed reaction – Much of the first half of 2022 was a story of inflation surprising to the upside and bond yields rising, followed by central banks reacting to the obvious and raising overnight interest rates. We continue to believe once the market can even see the light at the end of the tunnel for rate hikes, there will be a strong rally. As market concerns migrated from inflation to recession risk around mid-June, peak rate expectations moved sooner and lower. And markets rallied.

The recent strong payroll data has triggered a bit of an upward move in expected peak rates, and this may be slowing the current market advance. Our view is headline inflation will begin to fall soon, and we do not believe Fed Funds will reach the current levels priced in as the peak in early 2023. The economy is slowing, and inflation pressures are softening.

Add this up, and you could see a decent and sustained rally in the market. But this could change quickly based on the data. If inflation remains even more stubborn. This is very data dependent.

Improving economic data – Slowing economic data and then a second consecutive quarter of negative US GDP, the recession talk has become very loud over the past couple of months. Here in Canada as well and many pockets globally. The TSX, which is more sensitive to the global growth trends than the S&P, actually bottomed in July and started moving higher. The S&P is more sensitive to rate expectations given its longer duration growth characteristics, while the TSX is more a global economic growth barometer.

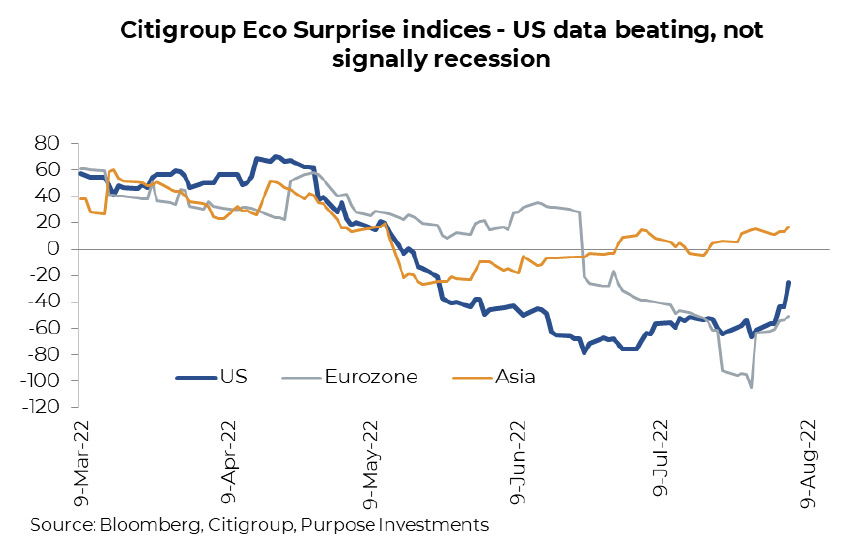

While the recession chorus has grown louder, the good news is the economic data improved in July and into early August. Please note we are not claiming the recession risk is gone, more painting a picture as to why markets continued to rally into August. This is a fine line because if the economic data improves too much, inflation persists for longer.

The recession talk has quieted a bit, given the recent data. Not sure how long that will last, but it is positive for now.

Investment Implications

Bear markets or periods of weakness end when they end. There isn’t a siren or signal that marks that point in time. There isn’t a magnitude of decline either. Months after the bottom, a narrative gains enough popularity that includes why it ended when it did. Bear markets end when the aggregate behaviour of investors (dollar-weighted, of course) changes. That could have been in mid-June, but this does look and feel much more like a bear market rally grabbing onto some improved news from a starting point that was very oversold.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.