Dominating Dollar

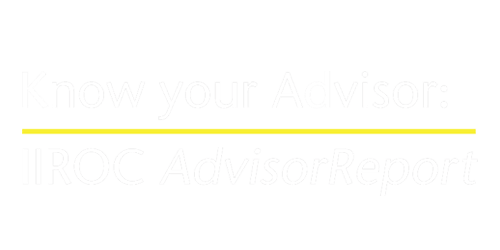

In normal times—if you can remember those—asset class volatility was a declining range from the most volatile equities to bonds to the least volatile currencies.

We are not saying this relationship has changed, but with bond and currency volatility historically high of late, the range has certainly narrowed. Given the inflationary environment and response from central banks, the elevated bond market volatility is understandable. Even the risk-free rate, which is normally stable, has become unstable and uncertain. But today we are talking currencies.

There are many factors contributing to higher currency volatility. Divergent central bank policies are one factor, with the U.S. Fed currently on a more aggressive tightening path compared with the European Central Bank and even more so as compared with the relatively dovish Bank of Japan. But relative interest rates have taken a back seat to fundamental factors. Europe has an economy that may be flirting with a recession and an ongoing energy crisis. Couple this with inflation, the region is in a tight spot that is not supportive of the euro. Japan is not yen positive, with its dovish policy and being a big importer of energy with lower inflation. None of this is news and it’s likely well priced into current levels.

Meanwhile the U.S. enjoys a stronger economy than most, plus it is a nation that is largely energy and food independent. Energy and food self-sufficiency has become a big driver of currencies during this period of energy and food uncertainty. This has also helped our Canadian loonie. While it may appear on the surface that the CAD has lost ground against the USD, the CAD is up nicely against most other currencies.

What next

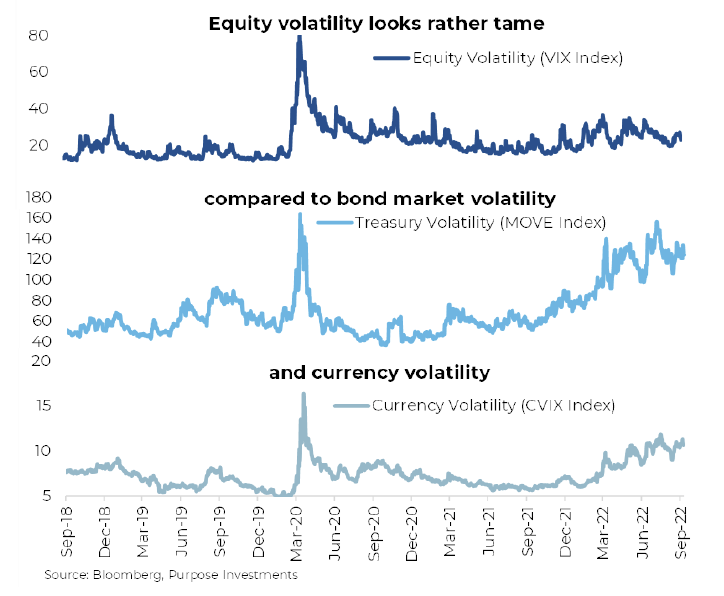

Honestly, when it comes to currencies, who knows. Forecasting currencies is arguably one of the harder components of portfolio construction. That being said, if you believe the global economy is set to continue to decelerate, the USD tends to perform well during that backdrop. There has been a strong negative correlation between the USD/CAD exchange rate and global growth. If growth is accelerating, the CAD does well, if decelerating the USD does better. We are in the camp of a slowing global economy.

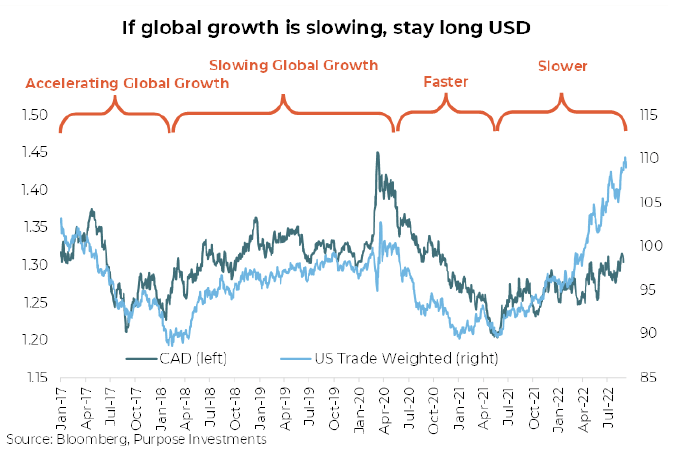

Even if you have a more negative view of the USD, given its rise, or a positive view on CAD, for some reason, you cannot deny the diversification benefits of USD exposure within a Canadian investor’s portfolio. 2022 has been a challenging year for all, with equities and bonds falling simultaneously. The more common negative or zero correlation between equities and bonds is clearly not evident during this re-pricing of all assets. However, the USD has been strongly negatively correlated against equities, thus providing a strong diversification benefit for portfolios.

Portfolio Construction

With the global economic growth outlook slowing, we remain in the camp that U.S. dollar exposure in portfolios is a good factor. Not saying we are very bullish on USD vs CAD at current levels, but given the slowing Canadian economy, it is likely the Bank of Canada blinks first compared with the Fed. It is a bit more challenging globally, but worth noting that the euro and yen are at very depressed levels vs the CAD (and obviously vs the USD). As such, we tend to lean towards not hedging globally at this time.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.