Forecasters’ Folly – Insight Versus Inanity

Investors often look for a playbook, a way to help guide them through times of uncertainty.

History is often used to write that playbook. However, markets are just like any sport – rules change, equipment improves, athletes progress, and what worked best in the past may not always apply to the current situation. Playbooks need to be constantly revised, but despite revisions, any playbook or research created to guide investors is really based on two fundamental questions: what will happen, and more importantly, how will the market respond?

There is no shortage of forecasts and inane opinions in the financial media. Just sound smart, maybe say something controversial, and you can get plenty of coverage. Individuals can also be incentivized to make a name for themselves, build their personal brand, and bring more revenue to their firm. Fear drives eyeballs and eyeballs bring in the advertising dollars. Unfortunately, it can be easy to conflate the opinions with the most coverage with those that are the most accurate. Forecasting is hard, and as history shows, often not accurate, especially when it comes to the stock market.

Forecasters’ Folly

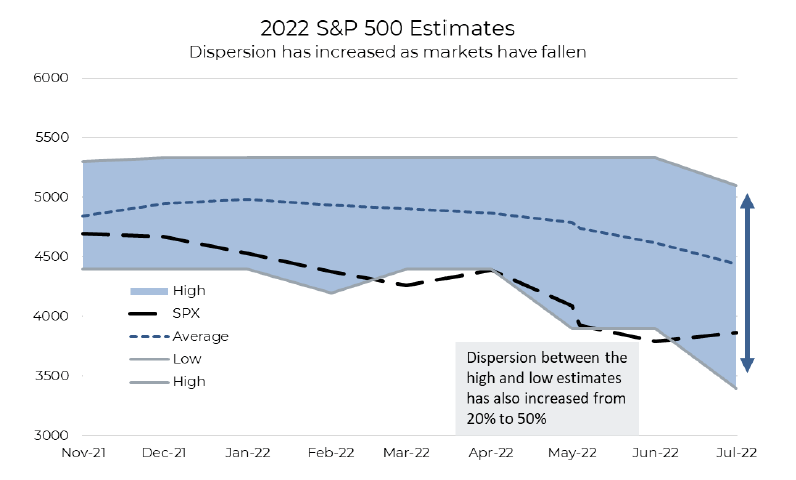

Market strategists at the largest banks typically all have year-end S&P 500 targets. These get a lot of attention at the beginning of the year, and any time they get materially revised. Consensus targets for the S&P 500 tend to follow prices, not the other way around.

Using just the past couple of years as an example, you can see that forecasters were eager to hike estimates as markets moved higher off the Covid lows. At the beginning of each year, the estimate was moved higher to provide a larger cushion. Whether the targets are generated by estimating forward EPS and applying an average multiple to it or simply taking a year-end value and increasing it by 5-10%, these targets have poor accuracy and should carry little weight when constructing a portfolio.

The implied return on the year-end forecast to current prices recently peaked at 26%—an attractive entry point based on the past 20 years. For all the folly of forecasters, an expected forward return like that can seem tempting to even the most sophisticated investor. Remember though, forecasts tend to follow price and not the other way around.

At the beginning of the year, the difference between the high and low-end S&P 500 year-end target was 20%. As volatility surged and markets plummeted, the bears have become significantly more bearish, but it wasn’t until July that the most bullish strategist lowered their target. The dispersion has widened significantly over the year, with a staggering 50% gap. This introduces a significant amount of noise into the street’s consensus, which can make it more difficult for investors to determine the potential path ahead.

Information Overload

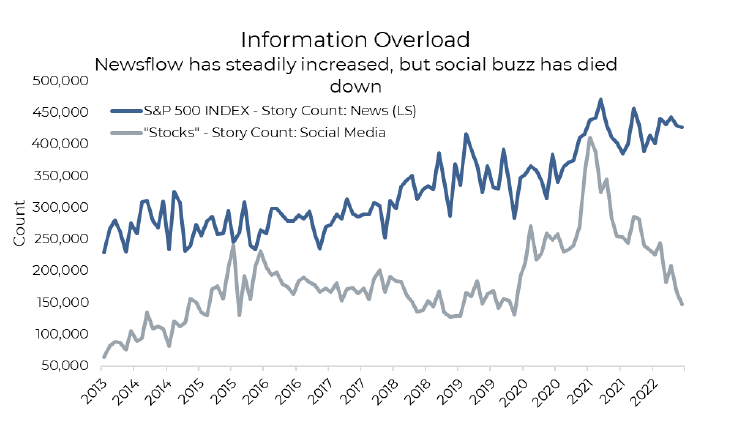

We live in the information age: a bombardment of news, forecasts, and opinions can impact how we make decisions. All too often we hear of exploding inboxes and an inability to simply stay on top of the news. Beyond consuming daily market recaps, research round-ups, flash notes, economic releases, and company earnings, it’s hard to stay informed.

The flow of information is only increasing: take the chart below, which simply plots the daily news stories mentioning the S&P 500 on Bloomberg. Though a little erratic, the trend is clearly up and to the right. Beyond news stories, you also have social media, which increasingly dominates our time spent consuming information. The social media story count for “stocks” hit its peak during the meme stock bubble in early 2021 and has since fallen, but interest will probably rebound again during the next mania. In addition to variance in street consensus, the increasing amount of news makes it even harder for investors to find high-quality opinions backed by solid analysis.

Echo Chambers

Confirmation bias causes investors to seek out and evaluate information in a way that fits with their current beliefs and preconceptions. Essentially, it’s human tendency to pay more attention to information that supports your view and discount or discard information and evidence that is contrary.

As a media example, Fox News caters to the right wing of political views. The audience is dominated by right-wing-oriented viewers, and the content serves to confirm their views. Likewise, the far left tends to gravitate to news sources that reinforce their views. To garner a more holistic view of topics, absorbing multiple sources of media, some that agree with preconceptions and some that offer contrary views, results in having a better understanding.

Confirmation bias can narrow an investor’s focus and cause us to miss a big risk or change in direction. It can also embolden investors to take on more concentration risk in an asset class, sector, or position.

So, how can you defend yourself against confirmation bias? Force yourself to consider why an investment or strategy may not work out (prospective hindsight). Think: what could go wrong with an investment? This makes you more open to seeing and considering contrary views and evidence.

Investment Implications

Persuasive commentary about the markets is perhaps one the biggest traps for even the smartest investor. As Warren Buffet once said, “You can’t get rich with a weathervane.” It’s important to put the work in and do quality research of your own. Be wary of bold predictions and those claiming to know more about everything, seeing what no one else sees. The best approach is to identify and blend knowledge from trusted experts, along with looking into the data yourself and doing your own thinking. It can be challenging but, in the end, it is much more rewarding.

In addition, we’d also stress the importance of continuous advice—ideally tailored to your current portfolio. How often do you come across a useful piece of research recommending certain stocks or sectors? Perhaps, you agree with the analysis and decide to allocate. It might work out for a period of time; however, perhaps it gets forgotten and becomes a stale position.

Without continuous advice and monitoring, it is easy to hold for too long. Try to rely less on point-in-time recommendations, without putting in place a solid plan to revisit and stay on top of current research. Consistent content is hard. Hard to write, but also hard to follow.

— Derek Benedet is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.