On a Warm Summer’s Evening

On a train bound for nowhere . . . or so the song goes.

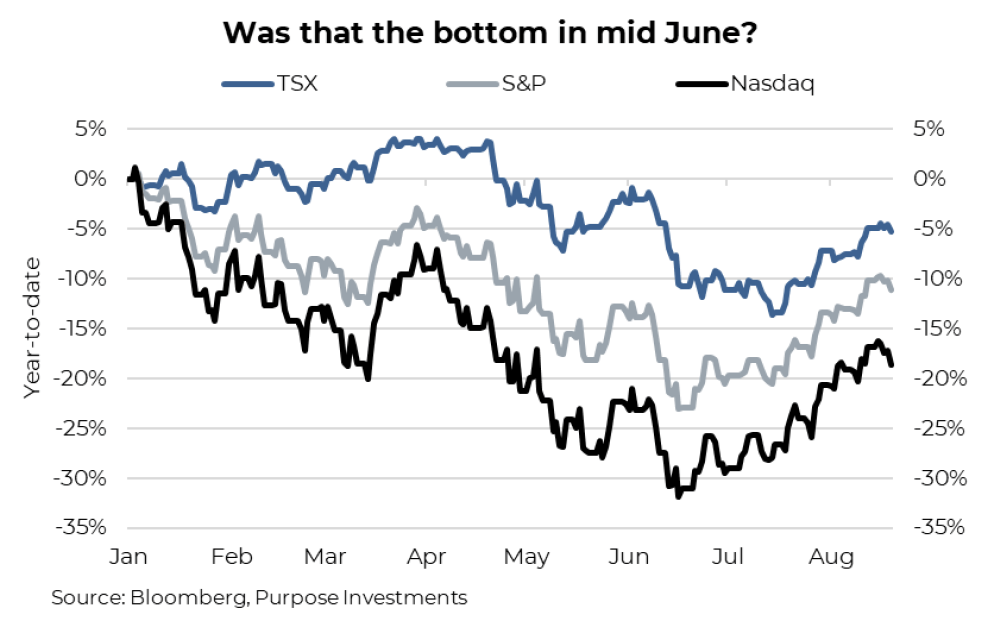

Investing is NOT gambling; done right, it incorporates thoughtful portfolio construction incorporating objectives with capital market assumptions influenced by the current environment and expectations going forward. But sometimes gambling is afoot in the markets. Bed Bath & Beyond does not have a new must-have bathroom accessory product that would justify the share price jumping from $5 to $25 over the past week, with the subsequent drop back down to $11. Yes, the Reddit/options traders are at it again. But the biggest gamble may be the recent rally in the markets. A few days ago, the S&P 500 reached a level in which it was down less than 10% compared to its all-time high. A little weaker since then, but still an incredible rally from the lows of mid-June. The S&P has risen +17%, Nasdaq +22% and TSX +11%.

In the history of bear market bottoms, the recovery is ALWAYS questioned for months with tons of well-founded convincing naysayers. Over time, the negative nellies concede it's over, and markets return to their normal upward trajectory. Could this be that? Maybe. But count us in the 'naysays' camp after this market rally. We turned much more positive at the beginning of July in our outlook for the 2nd half (HERE). This was predicated on a few things, including the degree of the drawdown, the view that inflation would begin to soften, and that recession fears were a bit overblown. But this advance does appear too far and too fast.

Short covering combined with some softening inflation data and improved economic data, which allayed recession fears during the less liquid summer months, drove this rally. And now, the market is gambling on a perfect future. Think about it. The S&P is down 11% from a high that was a bit of a speculative peak to round out the +28% appreciation in 2021. Down only 11% with inflation softening but still a risk. Down only 11% with earnings revisions turning negative, the Fed is still on hiking autopilot and, despite a few recent economic data points, recession risk is still real.

This market appears to be sitting on an open-ended straight, hoping for a good river card. Maybe inflation will come down fast enough, allowing the Fed to stop raising rates. Maybe yields will stabilize, the economy will have a soft landing and earnings growth won’t slow materially. Or maybe this market rally just keeps going higher on short covering of bearish bets. It could happen, but the probability does not look great.

This has been the summer bounce rally. Market Ethos June 20th: “Our base case remains that as the economic data softens, the inflation fears will too, leading to a market bounce. But we could also fast forward to recession fears as earnings/margins come under pressure. Valuations are increasingly providing some margin of safety, but this will continue to be a challenging year.” That valuation safely margin has certainly been reduced. In early July, the S&P 500 was back down to its long-term average of 16x forward estimates. Now it is back up to 18x, not expensive, but if you are less confident about the sustainability of the ‘E,’ certainly less safe.

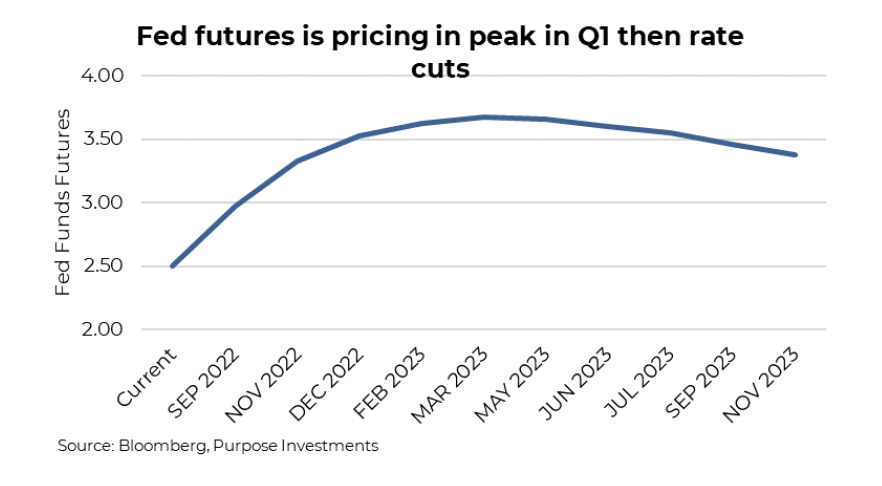

And then there is the all-important Fed. The world knows, given inflation, that the Fed will likely continue to be aggressive on hikes this year. Notably, the market is pricing overnight rates to peak in Q1 at just over 3.5%. After that, the market is expecting the Fed to start cutting rates. Of course, this is a moving target, and this curve moves with data and likely Fed talk. But try to imagine why the Fed would be cutting in mid-2023. Maybe inflation is all the way back down to the target rate of 2%? Seems unlikely given the various nuances of inflation and stickiness (very slow to react). Or it is because the economy has slowed so much that stimulus is required. If that is the case, that is not good news for the markets or earnings.

Investment Implications

Don’t get us wrong, we are not bouncing from having a positive outlook for the 2nd half to being bearish. However, if you had added some U.S. market exposure when it was hardest to do so in those tough months of May and June, dialling back, given this rally, seems prudent. We are approaching two months that have historically been a bit unkind for investors. And betting big on the river card often does not end well.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.