It Is 2023, Not 2008

It’s fair to say that investors remember the last bear market the best; the one before that is a hazy memory, and if they have been investing long enough, the one before that is almost forgotten. This is part of recency bias. If we skip over the pandemic bear burp, the 2008 global financial crisis was the last bear market. So, it’s not surprising that when a couple of regional banks fail and a large global European bank appears on the ropes, the memories of 2008 are still vivid. ‘Sell first and ask questions later’ has pushed U.S. regional banks down 25% in the past week and a half, and the big banks down 15%. All bank shares have been under pressure, with the Canadian bank index off 8%. Broader markets are down a bit, but this so far appears isolated.

So are Silicon Valley Bank (SVB) and Signature Bank the Bear Stearns and Countrywide of this bear? Those latter two were early to collapse before the crisis really got going in the Fall of 2008. The short answer is ‘No.’ 2008 was caused by bad assets and CDOs, and upon realizing the value was not there, banks and other companies failed. That was a solvency issue. Today, the failure of SVB and Signature appears more of a liquidity issue caused by bad business models in a changed environment, not an asset issue. But we also remember similar statements were prevalent back in 2008. So that might not be totally reassuring.

SVB’s demise appears to be more of an asset/liability mismatch that deteriorated as deposits were suddenly pulled. On the positive, the asset side is not overly complex leveraged assets such as CDOs in 2008. Perhaps the real takeaway may be that an extended period of an artificially low cost of capital and too much abundant capital led to an explosion of venture capital growth businesses (small & med sized tech firms and CEOs in their 20s with business plans written on napkins). Now that capital has a real cost (yields up and less abundant access to capital), many of those ventures are proving to be a tad overly optimistic or require continued free and plentiful capital to continue, which no longer exists. So, should we be surprised a bank that primarily focuses on this niche of the technology industry has failed? Or, in Signature’s case, a bank sensitive to the gyrations in the digital asset space? Greater variability in both inflation and economic growth does not encourage higher earnings multiple for equities. Depending on a market's current valuation, this may prove to be a headwind.

Higher rates = higher cost of capital. That is the tide going out, and now poor business models and capital allocations are being punished. It is the circle of life (or the circle of capital). This has highlighted that a diversified deposit base has become extremely important for banks and other lenders. Especially given movements among deposits. The bigger the bank, the more diverse the deposits (usually).

What happens next?

Will there be other shoes to drop or other vulnerable business models exposed? No doubt. The era of easy money has ended, and many companies need to pivot. This will continue to be a challenging period. For the banks, a period of ‘no news’ would certainly be positive and could easily lead to a relief rally. But make no mistake, the stresses of so many rate hikes and higher yields over the past year continue to work their way through the economy and financial system. And while the sudden drop in yields over the past week is welcome, potentially alleviating some stresses, it may be causing stresses elsewhere. At the end of February, the net speculative positioning in the combined options & futures market for bonds was VERY short – making this sudden drop in yields (rise in prices) very painful. Some investment models are clearly feeling this pain now.

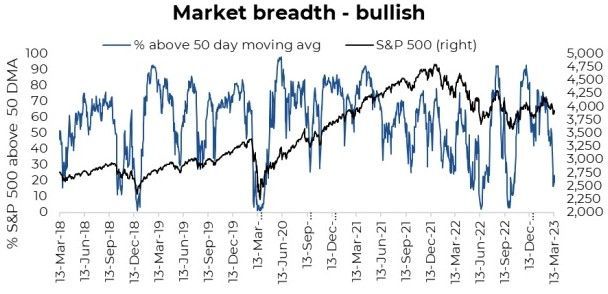

Sticking with the short term, it is worth pointing out that the market appears poised for a bounce. Relative Strength got down to a buy signal on Monday (near 30). Market breadth for the S&P 500, measured by the percentage of companies above their 50-day moving average, is bullish (meaning oversold).

The AAII investor survey, out on Thursday the 16, has 48.4% bearish and only 19.2% bullish (net -29.2%). That is bearish, which often coincides with short-term troughs. The put/call ratio pushed over 1 on March 10, another buy signal. Put all this together, and a rally could be afoot. But just as we penned in on February 6 (Rent This Rally, Don’t Buy It), we would be ‘renters of this rally, not buyers.’

2023

This banking flare-up has not changed our view for 2023, and in fact, it is supporting evidence. Last year inflation was the largest angst for markets, which we believe peaked in the fall. While inflation won’t follow a straight line lower, as evidenced by a small uptick lately, we believe the general path will be down. As inflation fear fades, markets rally. That is what we saw to start the year. But this inflation fear will gradually be replaced by economic/recession fear as the year progresses.

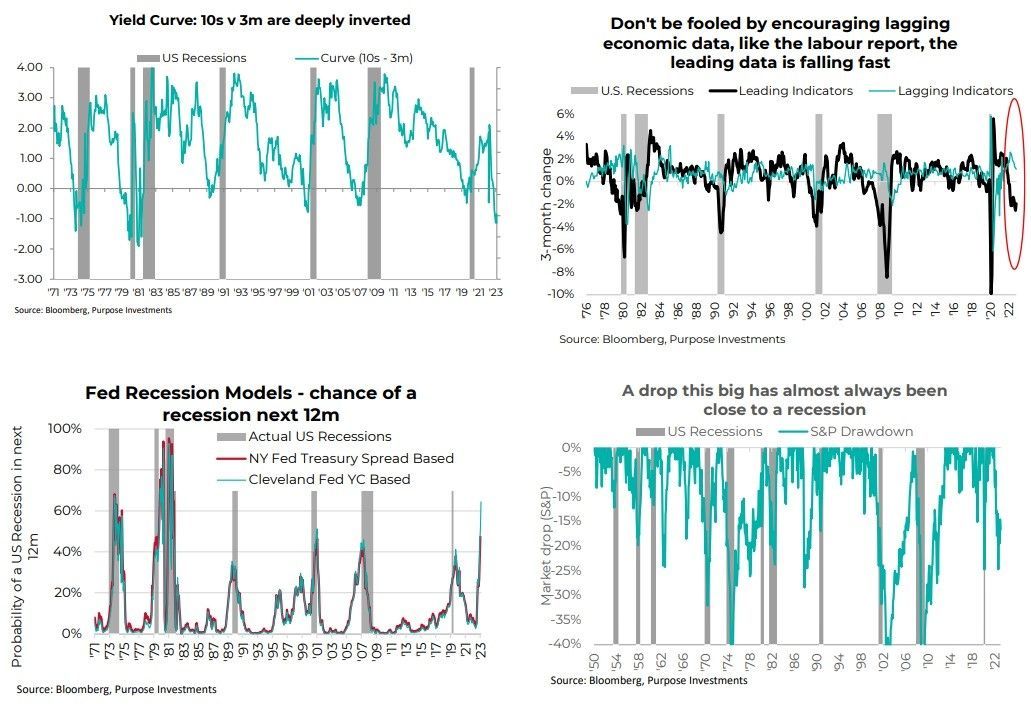

The economic data at the moment is very mixed. We have an inverted yield curve, leading economic indicators that are negative, Fed recession models that are flashing a warning sign, and a drop in asset prices that often precedes a recession.

Meanwhile, on the other side of the economic ledger, we have a consumer in decent shape and a healthy labour market. But these are not leading, more coincidental or even lagging. So if you look out the side window of the bus, everything looks hunky dory…just don’t look out front.

Even if these bank issues fade, there will be an implication for quarters and years ahead. With what has happened, credit just got a lot harder to come by. Banks will continue to become more restrictive and conservative. That is deflationary and will continue to bite into economic growth.

Finally, what do you think it looks like as a recession approaches? Over-levered or vulnerable business models are exposed first. Well, check that box over the past week. And if you had previously given the probability of a recession 50%, which way have those odds moved in March? (hint: higher).

Final Thoughts

Nobody knows if a recession is a certainty in 2023 or even 2024. For us, best to prepare for it and be pleasantly surprised if a recession is avoided. Much better than denying the recession risk with rose-coloured glasses and being surprised if one develops. After reducing international equity and adding to bonds at the beginning of March (Worth a Read or Two), our balanced model is underweight equity and overweight bonds/cash. Plus, we are carrying a nice duration of just over 5 for our bonds. We prefer leaning into defense – bonds, dividend-focused equities and defensive alternatives.

Trade this market turmoil or potential price overreactions if you like, but best to remain a short-term renter.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.