Stuck

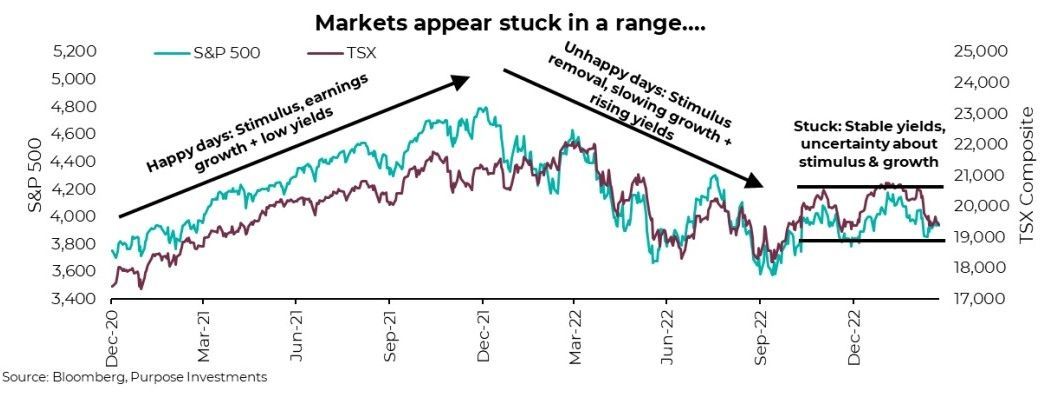

If you take a step back from the day-to-day market gyrations, it appears we are stuck. In 2021, both the TSX and S&P rocketed higher on the back of continued stimulus, solid economic growth, and low yields—the perfect combination for a very investor-friendly market.

2022 saw a reversal in these factors, as short-term rates jumped higher with central banks hiking to combat inflation. Longer yields rose too as economic growth continued. While earning growth remained decent, higher yields caused the market multiple (valuations) to come down, resulting in a rougher market for investors in both equities and bonds. But since rate expectations and yields plateaued, the stock market has become stuck, oscillating within a narrow range. For the S&P it has been 3,800-4,200 and 19,500-21,000 for the TSX.

So how could the market become unstuck and, most importantly, in which direction?

Market moves can be boiled down to two things:

1. Earnings growth, and

2. What the market will pay for those earnings (aka valuations or market multiple).

Both are complex and have many moving parts. Here is our take on what could get the market unstuck.

Market Multiple – Up or Down From Here

The market decline in 2022 was really just about 100% multiple contraction. As yields and rates rose, the discount rate for valuing assets also rose, which results in a lower multiple. Bonds or cash yielding more, means equities have to have a higher expected return. The natural path is for the multiple to compress. The S&P went from almost 24x to a more respectable 17.5x. That is good news: 17.5x is a big below the trend given current 10-year Treasury yields of 3.4% (big red dot) and just about inline with the long-term average multiple. And if you look outside the U.S., it gets even more comforting. The TSX multiple moved from 15x to 12.5x, below its long-term average. Same with Europe and Asia.

Since bond yields clearly influence the market multiple, where to next? If inflation re-accelerated or this recent uptick in the economic data continues, bond yields would probably head higher putting downward pressure on the market multiple. However, our belief is that inflation is going to trend down this year and recession risk will rise. In this kind of environment, yields will be hard-pressed to rise materially. This is good news for the market multiple, but…

Risk or investor risk appetite also factors into how much investors are willing to pay for earnings. For instance, a few bank failures and stress in the banks around the world adds to risk, so the multiple drops. As we penned last week, we do not believe this flare up of issues among banks will become a material problem for the markets (see our article, It Is 2023, Not 2008 for more insight).

Of course, it could become a bigger issue if depositor withdrawal activity broadens substantially. However, the stress currently appears really focused on the banks whose business models are well suited for today’s environment, whether that is a less sticky or diversified deposit base, poor asset investments, or narrow focus on a part of the economy struggling.

If the bank fears fade, as we believe is the most likely path, that could help the market uptick a bit. But probably not all that far. If it worsens, there is probably more downside risk for the market in general.

Risk of a recession is starting to add up. If investors are comfortable that the economy is on a good growth track, they will pay more for earnings. If the future is less certain, like now, they pay less. We believe rising recession concerns will continue to put downward pressure on the multiple this year. While the positive uptick in data of late has helped more believe a soft landing is possible, we do not expect this to last. And this bank flare up has likely increased this risk.

Earnings – It’s Hard to Get Excited

Earnings have proven more resilient than most expected, including ourselves, during the past year. Yes, costs have been rising from wages, input costs and the cost of capital, but inflation also has led to revenue growth that has helped offset. Earnings dipped a little for the S&P 500 but remain at solid levels, largely thanks to inflation. Don’t forget, corporate earnings and sales are nominal.

Now if inflation is starting to cool, that is probably not good for earnings growth. And if the economy is starting to slow, that too isn’t good for future earnings growth. We are already starting to see margins come back down as topline sales growth slows.

Final Thoughts

There is the rub. If inflation cools and yields come down, this augers for a higher multiple. But cooler inflation will be a headwind for earnings, assuming input costs are stickier than output prices. And if yields are falling due to a slowing economy, that is a double whammy as volumes may contract. Given recession risk, earnings growth risk, we just don’t believe the market is likely to enjoy much multiple expansion. In fact, some further contraction may be the more likely path.

This market could become ‘unstuck’ on good news, like cooler inflation encouraging the Fed to cease raising or this bank risk calming down. But we question how far that rally could go given weakening fundamentals. This has us thinking the risk appears tilted to the downward direction. The earnings/recession uncertainty phase of this ‘bear market,’ which could prove to be the bottom and mark the beginning of a new cycle.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.