Thinking Long-Term Returns

It is fair to say we spend a good portion of our time researching, thinking and talking about what will happen this week, next week, next month, and next quarter. Will inflation come back down? Is there a recession coming, and if so, how will it look? How could capital markets react? Then, of course, constructing and managing portfolios that are more resilient to what may lay ahead to help our end clients navigate the road ahead. While many clients are interested in what may come next, of greater importance is the long-term investment journey towards whatever their long-term goals may be – aka the financial plan.

Sadly, nobody knows what the next 20-30 years will look like, so input assumptions into these long-term plans typically rely on the long-term historical returns. With the uncertainty of looking that far into the future, long-term historical assumptions are often best. However, in the near term, say five years, there are factors that can help or hinder returns around these super long-term averages. Starting points matter considerably, whether those are valuation levels for equities or yields for bonds. The economy, too, moves in cycles, and where you are in the cycle can help provide some insight for the next five years.

Themes that may impact returns over the next five years

Much has changed in the markets and economy over the past few years that will likely influence market returns in the coming years. Below we have identified, at a high level, a few of them. Some are positive, and some are not.

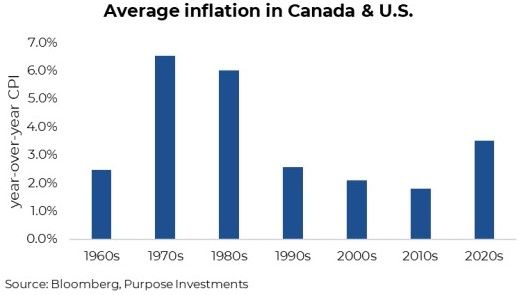

Inflation is a thing again – Inflation may have peaked or will in the near term, but it is unlikely to revert back to the disinflationary environment of the past decade. Demographics and the amount of debt is disinflationary but there are other trends that will remain inflationary. The move to be less reliant on fossil fuels, for example. Or the desire for more diversified supply chains, instead of just the lowest cost supplier, will be inflationary.

Inflation isn't terrible; it wasn't that long ago that the market was concerned about a lack of inflation. It is a positive for nominal growth in the economy and corporate earnings. It is negative for the real value of debt. Importantly, for long-term financial plans, one could consider a higher inflation assumption. Often in financial plans, a simple 2% is inputted for inflation, but how do the plan's forecasts change if 3% is used? A financial plan's sensitivity to living cost inflation has become a larger risk compared to years past.

The 2020s are still just getting started, but inflation is back to higher levels so far, and a repeat of sub-2% 2010s inflation appears unlikely.

Economic variability – The last cycle was dominated by a low, stable economic growth environment, with any signs of weakness receiving a central bank boost. That is over, or at least the boost will be less 'guaranteed.' We may have transitioned from a monetary rainforest to a drought. Meanwhile, individual countries' economic paths are starting to diverge. China is accelerating, Canada is slowing, the US appears to be slowing while Europe is improving. Desynchronized economic growth, or at least less synchronized, appears to be here.

Greater variability in both inflation and economic growth does not encourage higher earnings multiple for equities. Depending on a market's current valuation, this may prove to be a headwind.

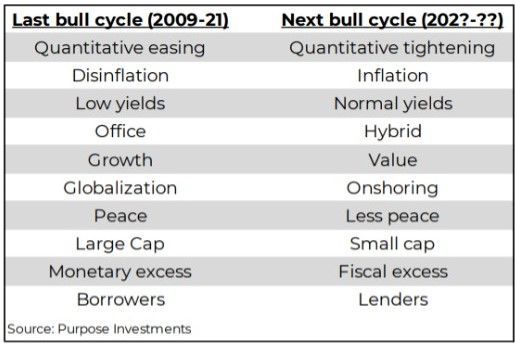

Yields & real cost of capital – Over the past years, the low (or artificially low) rates certainly helped the deleveraging of the 2010s and the recovery from the pandemic. It also led to poor capital allocation in the economy and speculative bubbles in parts. That regime appears to be over due to changing global dynamics. All of a sudden, capital is more scarce and has a real cost.

Many global, economic, and market factors that will impact future returns have changed over the past few years. This table from our report 'preparing for the next bull' tries to show just how much has and is changing.

Reversion to the mean - This is perhaps one of the biggest factors in future market returns, the equivalent of gravity in the financial world. Trees don't grow to the sky, and bear markets don't last forever – pick whichever catchphrase you like; they all try to encapsulate the same thing. Outliers tend to revert back to the average. How far outliers go, for how long and the speed of the reversion - that is anyone's guess. But a benefit of thinking out five years ahead is that it provides time for things to normalize.

The chart below contrasts the performance over the past ten years with the long-term compound annual growth rate. Just looking at equities this does not bode well for the U.S. International looks inline, and Canada has lagged. If reversion is the norm, that is good for Canada, neutral for international and negative for the U.S. The bigger difference is in bonds and commodities. They are due. Of course, with some caveats, future bond returns tend to cluster around yields. And we would be remiss not to highlight the last 10-year return for commodities started near the end of a secular bull market in commodities. Starting points really matter for returns, as do endpoints.

Today, as a starting point, matters

Equity market valuations do matter for longer-term forward performance. Breaking down the price-to-earnings (PE) ratio for the S&P 500 back to the 1950s and measuring the average forward 5-year annualized return from various valuation levels - high valuations are bad and low valuations are good.

Outside the U.S., valuations are not as stretched, which does portend for better returns on the international and Canadian equity markets in the years ahead.

On the bond side, perhaps one of the best predictors of future returns is the current yield or yield to maturity. Here too, there is some good news. Yield to worst for the Canadian and U.S. aggregate bond markets is now between 4-5%.

Final Thoughts

The future is very unknown, but with the changing dynamics in the market, our general views for the years ahead are:

US equities to lag, TSX to be ok and international equity to outperform. This should broaden to emerging markets but not until the recession risk or actual recession fades into the rearview. Commodities should do well given relative performance and potential for a falling US dollar in years ahead – perhaps more so after the recession risk fades. Finally, bonds are back. In the past bull cycle, almost 90% of the performance of a balanced portfolio came from equity allocation. In the years ahead, we expect this distribution of portfolio performance to be much more balanced.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.