Glass Half-Full

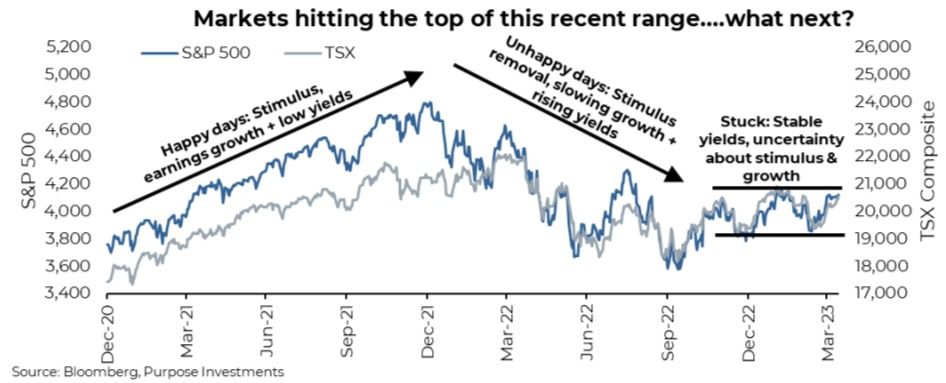

The S&P 500 rallied 7.5% over the past month from the bottom created by the U.S. banking flare up. Sure, the mega cap-techs helped more than their share, but overall it has been a decently broad-based advance. 84% of index members are up over the past month. A little over half of index members are also up 5% or more. The TSX is also enjoying a bounce – up 6% over the past month. It’s been a good month with the S&P and TSX bumping up against the top of a range that has existed for half a year now.

There has been some good news to help markets move higher. Firstly, the banking flare up appears to be fading. Not implying banks are in the clear, but deposits are on the move in search of vehicles with more attractive yields or safer homes. This is negatively impacting some banks (regionals) and benefiting others (money center banks).

Just look at JP Morgan’s latest results, deposits up nicely. Or look at Blackrock that enjoyed strong inflows in Q1 to bond and money market investment vehicles. Contagion or a systemic risk does not appear to be an issue.

Inflation has improved as well. This was the market’s biggest angst in 2022 so continued improvement is good news. And while economic growth has been slowing, it has been gradual at this point. The growth has been just enough for bond yields to come down, but not too much to raise the market’s ire over recession risk.

10-year yields in the U.S. have now come down from almost 4.5% to 3.5% and in Canada from 3.5% to 3.0%. If you like the porridge analogy for the economy, the data is cool but not cold.

Less inflation and lower bond yields fueled multiple expansion for the equity markets. The S&P 500 was trading at 16x in late 2022 and is now valued up at 18.5x. Meanwhile, the Nasdaq trading at 21x in late 2022 is now back up to 25x – clearly pricing in a good amount of optimism. While 18.5x may not be ‘expensive’, don’t forget the ‘E’ in the PE ratio is not proving as resilient these days. We are in the early days of Q1 earnings season, which based on current forecasts, has S&P earnings pegged at just over $50. This was nearly $60 last summer. Subsequent quarterly earnings have not been revised down as much. As each quarter’s earnings season approaches, we would expect downward revisions to accelerate. That has been the norm lately.

The recent high rally in the equity markets is fueled by multiple expansion, thanks to falling inflation and bond yields. However, falling inflation will prove to be a headwind for earnings going forward. And those lower bond yields — well they are lower because optimism for economic growth continues to dwindle, which is good for lower yields but not good for future earnings.

Final Thoughts

Future earnings are a bit “squishy”. And with the market enjoying the lift from bank fears cooling, inflation cooling and lower bond yields, could it keep going? Of course. The recent market has been reacting to just about any news as good news: glass half full. And when the Fed finally announces the end of rate hikes, markets may rejoice. However, this advance is being built on a rather shaky foundation. Don’t be afraid to take advantage of this recent bounce and continue pivoting to a defensive position. Or at least, be ready to do so in case the market switches to a glass half empty mindset.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.