Bonds Being Bonds Again, Who Knew?

For years bonds had a single job in portfolios, providing a ballast during periods of equity market weakness. Ok, maybe spin off a little income along the way. But most portfolios had been receiving as much or more of their income from equities, given yields were rather low. Then came 2022, and bonds didn’t just drop the ball – they fumbled, stumbled, and kicked the ball out of bounds. The TSX fell -5.8%, the S&P -18.1%, and Canadian bonds dropped by -11.8%.

For the past decade looking at rolling monthly returns for the TSX & Canadian bonds, there is no denying bonds have provided a good stabilizer for portfolios. Slicing the data to only those periods when the TSX declined, bonds, on average, were flat. Hence the stabilizer. But if you look at 2022 till the end of February this year, not so much of a stabilizer. During this period, when the market was down, it was down an average of -3.9%, and bonds were down an average of -1.2%. We don’t want to jinx it because one month does not make a trend, but March saw equities down and bonds up.

So, are bonds back to being bonds again? Maybe. March was an odd month with a bit of a market scare driven by fears over the impact of deposit flows on banks. Adding to this, the surprisingly strong economic data that had been the trend for the past few months has started to surprise a bit in the other direction. This was all good for bonds while not great for equities.

Forecasting correlations has got to be just about as hard as trying to forecast markets. But there are a few factors that tend to influence the bond/equity correlation over time. Correlations tend to be higher during periods of higher economic growth and lower when growth slows. Now if you are in the camp that the economy is slowing, as we are, then that favours lower correlations.

The bigger impact is short-term rates. When central banks cut or raise rates, the correlation tends to be higher. Now we are not jumping to believe this is necessarily a causal relationship. Often when central banks are cutting rates, there is trouble in the markets or economy, which is a risk-off environment that naturally enjoys a strong negative correlation between equities and bonds. But when they raise rates, it increases the discount rate for the valuation of equities and bonds – helping them move in tandem.

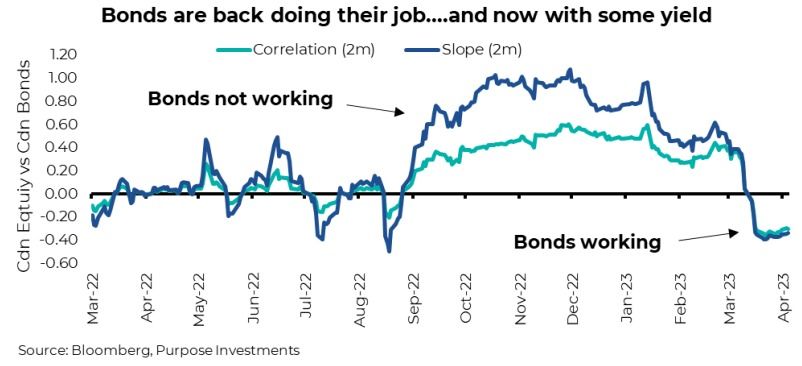

So if we have seen peak rates (or if we are close), and if the economic temperature is cooling, bond/equity correlations should be lower than we have seen in the past year. The chart below captures the rolling 2-month correlation and slope between equities and bonds. Correlation gets most of the attention, but the size of the move matters too. Both have turned negative of late.

Now, this could reverse for any number of reasons. First, if inflation re-accelerated or economic growth picks up, that certainly wouldn’t help. There is another buffer that helps bonds; namely, they now have a more attractive yield than years past. Perhaps one of the best charts we have come across to show this is from iShares. The chart below uses Bloomberg data to compile what percentage of the bond market trading with a 4% or better yield. It really highlights that yields today are simply back to more normal times, which is very different from the yield drought of the 2010s.

Final Thoughts

Inflation may not yet be over, and a recession is far from a certainty in the near term. However, the return of negative correlations between equities and bonds is a welcome change of events. The near-term sustainability of this relationship will depend on what lies ahead for the economy, risk appetite and, of course, the path of central banks. But with higher yields than years past and an increasing probability of a recession ahead, duration has quickly become a positive influence for portfolios.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.