Dividends on Sale

Investing isn’t easy. The markets rarely behave the way most think they should and seem to often behave to make the most people wrong. The financial media is filled with tales of fat tails – either things that went exceptionally well or extremely poorly. Pulling on those emotional strings to participate or capitulate, even when most investors' experience is squarely in the more boring middle. And when profits are made by putting your hard-earned dollars in harm's way, the government tends to show up to share in the party.

It's no wonder Canadian investors lean pretty heavily on dividends or the dividend factor. They’re historically less volatile, with good returns and some preferential tax treatment for Canadian qualified dividends. And while the previous paragraph may sound a bit down, don’t forget the eighth wonder of the world – compounding. As Albert Einstein famously said, ‘compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.’

Wise words. Steady returns and smaller drawdowns can create a lot of wealth over time.

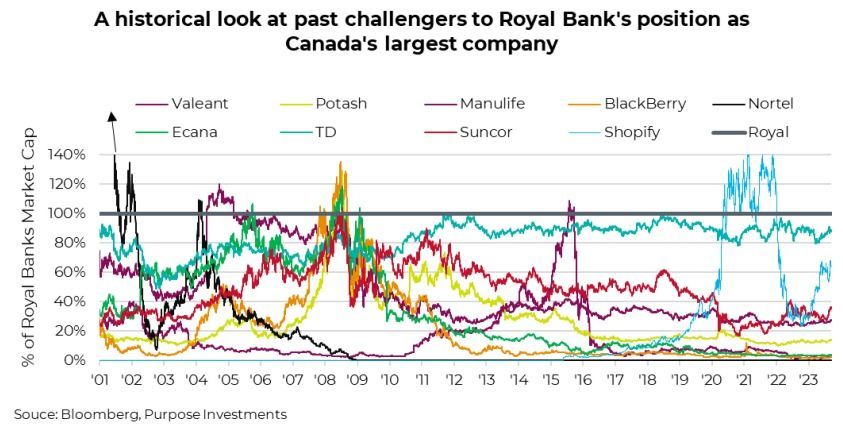

There is one more reason to explain Canadians' admiration for dividends, an often painful experience when deviating elsewhere in Canada. The chart below is kind of fun, and we do apologize if we missed a company along the way. This is a historical look at all the companies that, at one time or another, had a larger market capitalization than Royal Bank. Not implying Royal is a proxy for dividends, but it's still kind of a fun chart. There are many tough experiences among the names on this list, and you can add other groups, too, like gold, marijuana, etc. These all proved lessons that tended to keep investors focused on dividends.

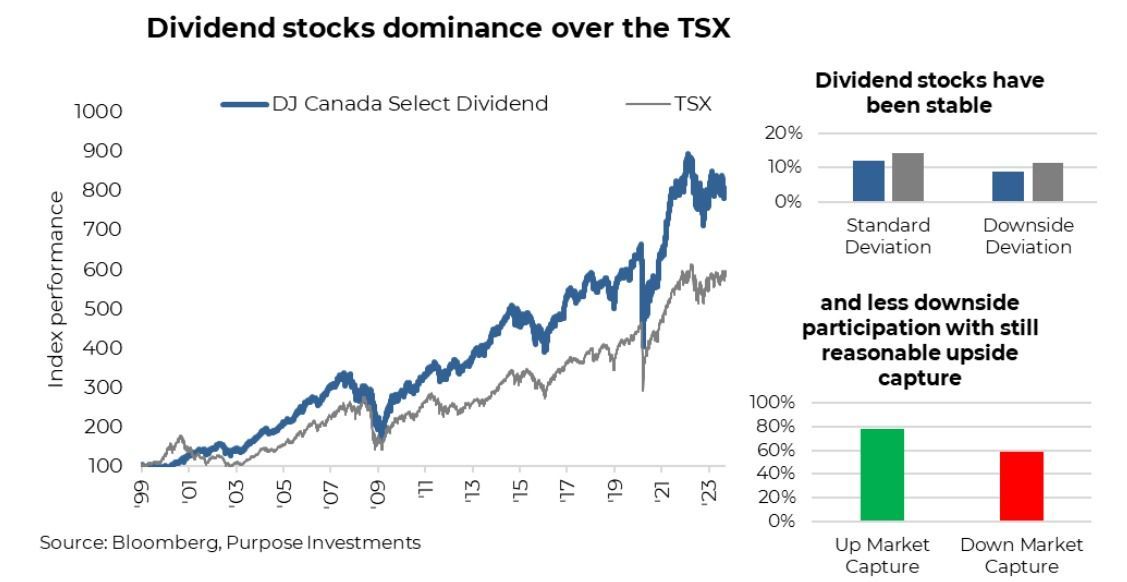

Of course, the good news is dividends have worked really well over the past 20+ years. Using the DJ Canada Select Dividend index as a proxy, dividends have outperformed the TSX rather handily over the years. And done so with less volatility, a happy combination.

We would never suggest investors ignore the past, but it appears some changes are afoot. Perhaps the biggest being yields. One of the positive impulses for the dividend factor over the past 20+ years has been the long grind lower in bond yields. As yields fell, investors looked elsewhere for a nice income stream, resulting in a steady inflow for dividend payers. It also encouraged more and more companies to adopt an investor-friendly dividend policy.

There’s no denying rising yields over the past two years have changed this tailwind to a headwind. The simple fact is if you can receive a 3.7% yield on a government bond compared to a paltry 1.5% a few years back, the yield on a dividend-paying stock must also move higher. It is not a 1:1 comparison because of different credit risks between governments and corporations, different taxation of income vs. dividends, coupons are guaranteed while dividends are not but often increase with time, etc. Still, higher yielding on competing asset classes is a headwind for dividend-paying companies, just as it was a tailwind when yields were falling.

To complicate things a little more, it isn’t as simple as looking at today’s yields but also where the market thinks yields are going. For instance, the broader TSX and the DJ Canadian Dividend index were roughly neck and neck in 2023 until a couple of months ago. So what happened? Well, the consensus started coming around to stronger overall economic growth and recession talk slowed. This increased the likelihood that yields will remain higher for longer, and guess what that means? The yield on dividend companies must be higher as well. The dividend yield goes up as the price of the stock going down.

Today, about 20% of the TSX constituents carry a yield of over 5%. That is up from 8% two years ago. To put it bluntly, higher bond yields have resulted in price declines for many dividend payers, which has helped lift dividend yields.

So, dividend-paying companies are now paying more to remain competitive with higher bond yields. There is also an added bonus: valuations among dividend payers are historically low. The dividend space in Canada is currently trading at about 10x forward consensus estimates, about two points lower than the long-term average. One could argue that given the current dividend yield and valuations, this part of the market is certainly pricing in higher yields.

Final Thoughts

So what comes next? If a recession or economic slowdown is looming, well, that is good news for dividends vs. the broader market. A recession would likely result in bond yields coming back down, somewhat at least. That would change the recent headwind back to a tailwind. And given the long-term defensiveness of the dividend factor, it’s probably not a bad thing if there is trouble ahead. Of course, yields could remain high or even rise (not our expectations, but possible). While that would be a headwind, the current dividend yields and valuations certainly provide a buffer.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.