Sometimes Even a Free Lunch Can Taste Bad

Harry Markowitz, the father of modern portfolio construction, is often quoted as saying, “Diversification is the only free lunch” in investing. Diversifying across more equity holdings, more bond holdings, more geographies, and more distinct asset classes reduces risk. This is why don’t put all your money just into one stock. If you pick the right stock, it is fantastic, but the downside of vastly higher probability scenarios is rather dire. So, we diversify across multiple equities, bonds, cash, alternatives, commodities, etc.

Diversification works because different investments have different correlations with one another. Correlation measures how two investments move in coordination with one another. The lower the correlation, the better the potential risk reduction benefits of adding to a portfolio. There is a return assumption component as well, but we will park that for now. Diversification works because different investments are not perfectly correlated.

But even a free lunch of diversification can leave a bad taste in your mouth. There is variability in the process. For your lunch, maybe the vegetables were not so fresh, or the chef was off that day. For diversification, correlations are not constant; they fluctuate. Sometimes correlations are stronger than usual, limiting the risk reduction benefits of diversification. Sometimes lower, really helping.

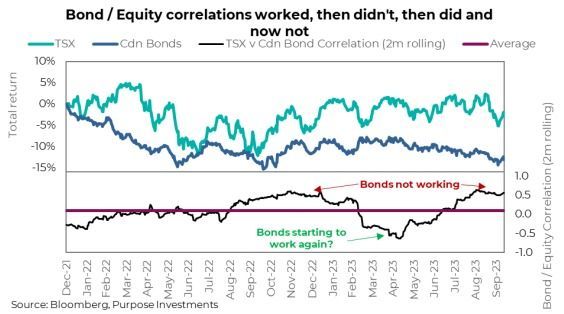

At the moment, correlations are higher, especially if you focus on the big two asset classes, bonds & equities (bottom portion of nearby chart). This does bring back some memories of the portfolio pain of 2022, which witnessed falling bond prices and falling stock prices. But starting in March of this year, correlations quickly turned negative and, more recently, back to positive. An easier way to glean this relationship is the following chart. It only looks at down days for the TSX and contrasts how bonds performed that day.

There is a very important takeaway from these two charts. Diversification didn’t work well in 2022 and 2H of 2023 (so far). But it worked well in the 1st half of 2023, which raises the big question – Why? 2022 was a unique year during which the overnight bank rate (as measured by the Fed Funds) moved from near zero to 4.5%, which dragged longer yields along as well. Guess what? If you raise the discount rate that much, the price of all assets moves in one direction: down. Correlations also increase, reducing the benefit of diversification.

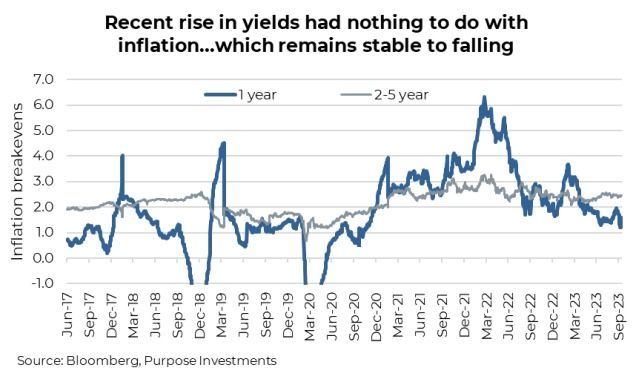

The first half of 2023 witnessed the expectations of peak rates plateauing or stabilizing for the most part. More importantly, with the economic risks around U.S. regional banks, recession risk moved higher. Bond/equity correlations became negative again, diversification worked, and we all enjoyed a nice free lunch. But now, in the second half of 2023, we have seen some recession risks fade and treasury issuance/demand risks (see last week’s edition). Once again, correlations elevated and diversification benefits dwindled. This is not the same as 2022, when it was an inflation problem. Inflation expectations and breakevens have remained relatively stable or even improved somewhat.

So, where do correlations go next? Inflation is gradually improving, lowering the risk of any material increases in the overnight bank rates. That is good news and supports lower correlations. If this recession starts to show up more, that too would lower bond yields and likely have bond/equity correlations behaving closer to long-term averages. On the other side, if yields keep rising due to imbalances or the ‘no landing’ scenario for the economy, diversification between equities and bonds will suffer.

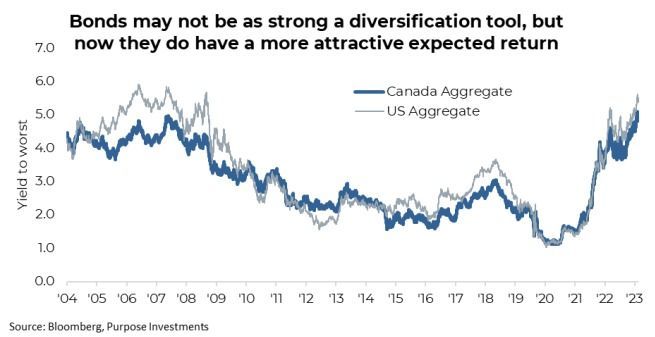

Has the job of bonds in the portfolio changed? There is a silver lining with all these higher yields: the future return of bonds is higher. Much higher than it was before, albeit a painful journey to get here. For instance, when the Canadian bond universe was yielding 1-2.5%, most investors owned bonds almost entirely for diversification or portfolio stabilization purposes. And while the losses over the past couple of years have probably cast some doubt on that stabilization role, there is no denying future returns have improved. The best indicator for future returns for bonds is the forward-looking yield.

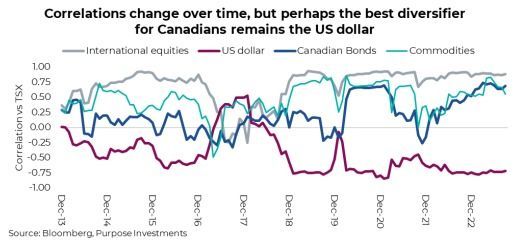

With bonds perhaps not as strong a diversifier as years past but with better future return prospects, are there other diversifiers? The chart below is rolling 12-month correlations between a few asset classes and Canadian equities. Clearly, international equities have a high correlation. You can see the bond correlation becoming elevated as well.

We also included commodity prices. Now, we could have used just energy, and the results are similar. This might be of interest as there are some who now argue oil or energy is a good diversifier because energy did well in 2022. This is recency bias; don’t fall for it. As is megacap tech.

The one line on the graph that stands out is the U.S. dollar. Yes, for Canadians, USD exposure is a strong diversification tool, given it receives safe haven flows during times of trouble. We’re not saying anyone needs to go out and buy USD; instead, just make sure you have enough USD exposure through other investment vehicles, such as equities or bonds. In a world where it is becoming harder to find diversification, US dollar exposure continues to deliver for Canadian investors.

Final Thoughts

We may not be fans of the US dollar when the next cycle truly gets going. But for now, we embrace it for its diversification benefits. And bonds may have failed to be the stabilizer over the past couple years but now offer a much more attractive potential performance contribution. Additionally, if a recession is coming, as we believe, it may quickly become that stabilizer once again.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.