Risk, it depends on your

Investing is all about balancing risk and return to achieve your long-term goals. I think everyone understands returns (especially when they're negative), but what about risk? In finance, the most popular approach incorporates the volatility or standard deviation of an investment's returns. Standard deviation may sound a bit mathy, but if you break down the term – standard or average and deviation or dispersion – it is just a measure of the variability of returns. Of course, many more metrics have become common, including downside deviation, up/down market capture, and drawdown. Really, they are all trying to paint a picture of the risk of an investment based on its variability of returns. But is that 'risk'?

Take risk-adjusted returns such as the popular Sharpe ratio (return divided by volatility). Both investments A & B in the chart below have the same return over the time period; however, A takes a much more volatile path to reach the same destination. Does that make B better than A? B certainly has a higher Sharpe ratio, but both result in the same wealth creation. This is where

risk really depends on you, the investor.

If you agree that risk is not just a function of volatility but of the investor, below we explore investor characteristics that also determine risk.

Behavioural Fortitude – Investing is an emotional endeavour, probably because we all care pretty deeply about our wealth. And greater volatility increases the risk of making a behavioural mistake when investing. On those big upswings, the Fear-of-missing-out (FOMO) may encourage adding more or taking on more risk. Conversely, during those downswings, the pain of losses (unrealized) can become realized losses if an investor capitulates.

If you are more likely to make a behavioural mistake due to market volatility (up or down), investments that are more volatile increase the risk of you making this kind of mistake. This applies to all investors, young or old, wealthy or less wealthy. If you have a greater fortitude to remain the course during periods of volatility, this is less of a risk.

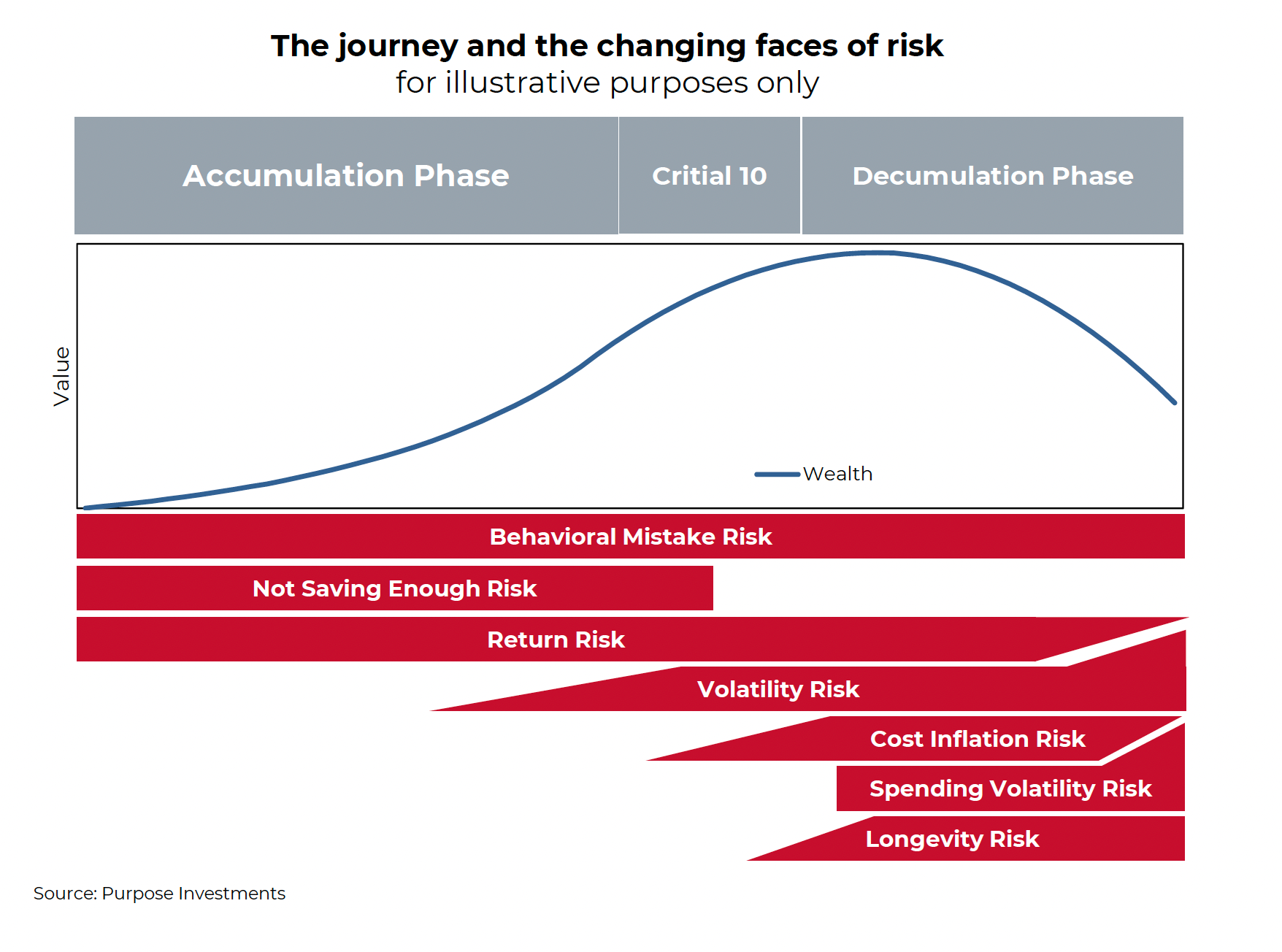

Accumulation phase – For those with a long time horizon and are currently in the accumulation phase, meaning net savings and regular contributions to your portfolio, volatility is less meaningful as a measure of risk. Simply put, the longer the accumulation phase remains for an investor, market volatility is less impactful, and the long-term return rate is much more important. It is the destination that is important, not so much the journey. Instead, the focus should be more on wealth creation, saving more and generating a healthy return.

Critical 10 - The term critical 10 is often used to describe the final five years of accumulation and the first five years of decumulation. Different risks begin to arise during this phase and will last into the decumulation phase.

- Valuation risk – As this phase likely includes the years of maximum savings rate, valuations matter even more. If equity markets are elevated, perhaps late in a bull cycle, the risk is your maximum contribution coinciding with buying high. Bonds, too, if yields are low, the risk is committing capital with a low expected future return.

- Expenses – When you are working and saving, it is hard to quantify what your living expenses will be after work is finished. On a beach, on a boat, or at home watching daytime TV. This Critical 10 period starts to provide a glimpse into what these expenses may look like.

- Volatility starts to become a bigger risk – without the buffer of regular savings and a long time horizon, a bear market/significant wealth decline becomes more challenging. Both from a portfolio recovery perspective and for your longer-term financial plan.

Decumulation phase – Ah, the golden years. Unfortunately, the golden years also come with more types of risk.

- Cost inflation – Some simple math can have a $2m portfolio, with a 5% annual return, last about 32 years with a starting withdrawal rate of $100k that goes up 2% per year (inflation). If cost inflation is 5%, it lasts 22 years, a decade less. For the more savvy financial planners, please excuse our simple math we are using to help articulate the point. With inflation likely higher in years ahead than it has been for the past few decades, this is a new risk [or an old risk that is pertinent again]. Taking on more risk to generate higher returns helps lessen 'cost inflation' risk, but with that comes greater market risk.

- Spending volatility – Spending during the decumulation phase is not smooth. In the early years, probably more spending, travel, etc. In the middle years, that spending may decline, and playing bridge is a low-cost activity. But in the late years, there could be added medical expenses.

- Longevity – The risk of living longer (a good thing but a planning risk). When more individuals had a defined benefit pension, invested in pension-like vehicles, or had kids that would allow them to move in, living too long wasn't as much of a risk. Today, it is. Most rely on having a buffer in their plan. Living longer means the estate is smaller. But living longer magnifies all the other risk factors.

- Market volatility is a big risk – As the decumulation phase progresses, a market drawdown becomes an increasing risk to any plan. And shedding market risk is an option, but this increases other risks, such as keeping up with cost inflation, spending volatility and living longer.

The above graphic is for illustrative purposes only as everyone's journey is different, and of course, there are many additional factors. The goal is to highlight that risks do change over time, and it goes beyond simple 'market risk' or volatility.

The Buffer – in many cases, these different risks are not addressed directly but instead are grouped into a financial plan's 'buffer' or safety buffer. If spending rises more than expected or life goes on longer, it simply eats into the buffer, resulting in a smaller residual (estate). Bigger is obviously better when it comes to a 'buffer,' yet understanding the changing risks is helpful. And if the buffer is smaller, understanding the risks become more important.

Portfolio Considerations

For the most part, portfolio construction is focused on creating thoughtful, well-constructed portfolios with an emphasis on risk (volatility) and return. Just look at the increased popularity of alternatives as a way to provide improved diversification (less volatility). This approach is ideally suited for the accumulation phase, as risk and return are the dominant considerations. Save more, grow your assets and avoid shooting yourself in the foot (behavioural mistakes). But is it time to start rethinking how we construct portfolios in the decumulation phase?

It is no longer just risk and return; there are many additional considerations. Individuals with a pension, annuity, or pension-like investments (such as Purpose's Longevity Pension Fund) that help address longevity risk can focus other investments more on other risks. Such as real assets or equities that can keep up with cost inflation better. Or focus more on return in the hopes of leaving a larger estate or protecting from a potential spike in spending needs later in life.

Portfolios likely need more customization as the combinations and permutations of income sources, risks, and goals vary greatly during the decumulation phase. And they continue to change over time. It is no longer just about standard deviation.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Disclaimers

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.