Planned Giving Strategies Using Life Insurance

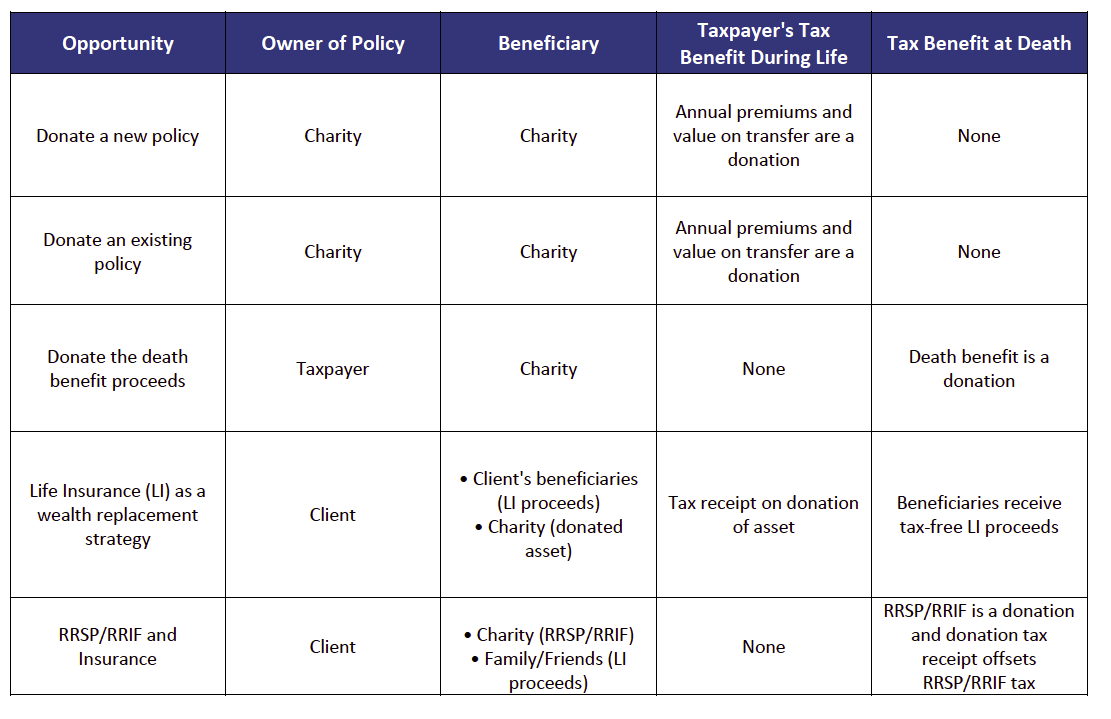

The following are some popular strategies that combine charitable donations with life insurance policies.

- Donate a new policy: Make the charity the policy owner and beneficiary, pay the premiums and receive the annual charitable donation tax receipt for the premiums paid. A tax credit directly reduces the amount of taxes you owe. There would be no tax receipt for the death benefit proceeds.

- Donate an existing policy: Donate a policy that has been in force for some time. Transfer policy ownership to the charity and make the charity the beneficiary. The charity can provide a donation receipt equal to the fair market value (FMV) of the policy transferred. An actuarial valuation should be obtained to determine the FMV. If the cash surrender value of the policy exceeds the adjusted cost basis of the policy, a taxable gain will result on the transfer. If you continue to pay premiums, you will receive an annual donation tax receipt. When gifting an existing policy, there are anti-avoidance rules that must be considered that could result in the donation receipt being the adjusted cost basis of the policy not the FMV. Whether the rules apply depends on length of time the insurance policy was owned before donating.

- Donate the death benefit proceeds: Remain the owner of the policy and designate the charity as the policy beneficiary. Continue to pay premiums, without an annual charitable donations receipt. The death benefit proceeds are received by the charity tax-free. Your estate receives a charitable donation tax receipt for the policy proceeds. Ensure you name the charity as the beneficiary, and not your estate, as this will skip any probate fees (outside of Quebec).

- Life insurance as a wealth replacement strategy:

Donate an asset (publicly listed securities, real estate, artwork, jewellery, etc.), and use the tax savings to purchase a life insurance policy, as a wealth replacement for the valuable asset that was donated. The tax credit received, will offset the capital gains tax on the asset donated (and potentially taxes on other income), and the value of the asset will be replaced within the individual’s estate. There is no taxable capital gain if publicly listed securities are donated to a charity but a donation receipt will be received for the FMV of the securities donated that can be used to offset other income.

- RRSP/RRIF and Insurance: Name a charity of choice as the beneficiary of the RRSP/RRIF accounts and purchase a life insurance policy equal to the balance of the RRSP/RRIF accounts intended to be donated, with friends or family being named as the beneficiary. Upon death, the life insurance policy death benefit is received tax-free and will not be subject to probate fees, credits, or any estate claims. Although the RRSP/RRIF proceeds will be included in the individual’s income on death, if this gift was made by a GRE, the estate will receive a tax credit up to 100% of net income in the year and the donation receipt will offset the income.

If you are considering a philanthropic gift, consider speaking to an insurance licensed agent of Chevron Wealth Preservation regarding creative ideas on how to enhance your donation and maximize tax-advantages.

New Tax Treatment of Charitable Donations

The following is an overview of the tax treatment of charitable donations made by individuals in Canada:

- Donors are entitled to a 3-tier tax credit: federal, provincial, and an enhanced credit for individuals in the highest tax bracket.

- Donors will receive a federal tax credit of 15% for donations up to $200, plus the applicable provincial credit. For gifts over $200, the federal credit is 29%, plus the applicable provincial credit.

- As of 2016, the federal tax credit is increased to 33%, plus the applicable provincial credit, to the extent that the individual’s taxable income is in excess of the highest tax bracket.

- A donor can donate as much as they want and receive a donation tax receipt for their entire donation. However, in any given year a donor can only claim a charitable tax credit for total donations equal to or less than 75% of net income for the year (100% in Quebec but for provincial purposes only).

- Individuals can carry forward any excess donations up to five years.

- For donations made in the year of death, if the estate qualifies as a graduated rate estate (GRE), the executor has the flexibility to claim the donation in deceased taxpayers return or the estate. Donations used in the year of death, or the immediately preceding year may be used against 100% of net income in those years. If the donation is used in the estate, the maximum amount of donations an estate can claim in a year is 75% of net income. There is a five-year carry-forward of unused gifts within the estate.

- Charitable donations made by both spouses/partners may be totaled and claimed by either person.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.