Active and Passive

This is a reprint of ‘Portfolios with a Purpose,’ a monthly publication spearheaded by Brett Gustafson focused on important portfolio construction topics. Other editions can be found HERE, and we listed the topics with links at the end of this post.

The debate between passive and active is not something new. There are strong arguments that can be made for both sides, but in our eyes, there does not necessarily have to be a clear winner of this battle. Investors who are fans of passive index following strategies often argue passive has a fee advantage and clear, strong performance. Proponents of active management often cite the mutual social good of price discovery, that certain markets are less efficient, and the importance of risk management controls around concentration.

The debate is often framed in a binary fashion— either active or passive. Yet, from a portfolio-construction perspective, investments, whether active or passive, are building blocks for building a portfolio. How the pieces are selected and fit together, given exposure to different factors at different costs in different markets, is much more important than an academic debate. After all, at the portfolio-construction level, all investment decisions are active, even if you opt to use market capitalization-weighted passive vehicles or more active strategies designed to gain or reduce exposure to certain factors.

Shades of Grey - Terms can be misleading, so before we get into the weeds of the active vs. passive debate, we should clarify a few things. Passive investing has changed a lot since Jack Bogle championed the case for index investing decades ago. Index investing is simply a way to gain exposure to an index. Historically, most indices were aggregates of certain securities trading in a certain market and weighted based on market capitalization. Funds or ETFs that track these indices are some of the largest in Canada and the United States. They feature massive liquidity and usually small fees. Active investing is any deviation from a set benchmark with the aim of a different performance experience. This can be in search of higher returns, less volatility, or even uncorrelated returns.

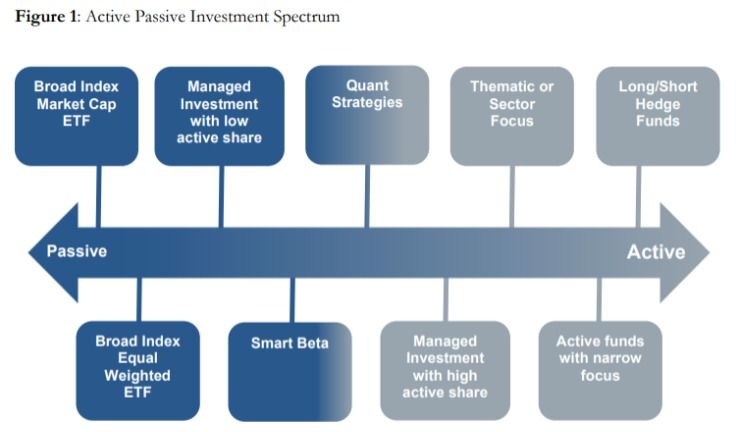

Given there is no shortage of available strategies, it is better to think of active to passive as a spectrum (Figure 1). A fund or ETF can sit anywhere along this spectrum, depending on the implemented strategy. And it’s worth noting that structure does not imply the strategy any longer. There are some funds that are passive and ETFs that are active. Life used to be simpler in the olden days.

The far-left - The far left of our active/passive spectrum is where you would find pure beta, low-fee index exposure ETFs and funds. The goal is simply to match the market returns of an index for a low fee.

For these, it is crucial to know and understand the underlying index. Are there concentration issues? The NASDAQ QQQ ETF has an 11% weight in Apple and 10% in Microsoft. There’s nothing wrong with that, as long as you’re aware of it when combining it with the rest of your portfolio. Even the broad-based S&P 500 Index can become very top-heavy. The S&P 500 has seen mega-cap names become increasingly weighted in the index. TSX, too, has seen material concentrations at the company level and sector level. Concentration is a risk that is worth considering. It can be an opportunity for active strategies as well if those megacaps begin to underperform. Remember, there is very little control for the risk in an index.

There is also market efficiency, as some underlying markets are more efficient and some are not. For a passive strategy, consider if it is easy to trade or if there are market inefficiencies. Fixed-income indices are often difficult to fully replicate and inherently provide higher weighting to the most indebted companies. Perhaps that is not the most ideal weighting scheme. Real estate and other private markets are also not well served by passive investments.

The far-right - Often, the most active strategies are simply trying to produce a materially different performance experience. Some are focused on the outperformance of their respective asset class. Others are attempting to produce lower volatility or provide uncorrelated performance for diversification benefits.

Manager selection and strategy are paramount here. Costs tend to be higher, so make sure it is truly a differentiating strategy. Active share can be a useful way to determine how closely a fund mimics its underlying benchmark. Research suggests that the deck is stacked against active managers when it comes to long-term performance. However, active management can still outperform – given the right combination of talent and discipline…a little luck never hurts either.

It’s important to pick your markets. Active managers typically have a better edge in markets that are less efficient or poorly designed in the first place. It’s very difficult to have an edge in large-cap U.S. equities, but emerging markets, preferred shares, and other smaller, less liquid markets are where active managers have a real edge. Some would include the TSX in this bucket of less efficient markets. Due diligence for any investment is important, but even more so for actively managed funds. There is a big divide between the best and worst, whereas there are only small differences when it comes to selecting between passive ETFs.

Everything in between - It’s the middle of the spectrum where the lines begin to blur. It’s where we’d place your smart beta, factor, and quant funds. Their primary aim is to provide alpha at lower prices by being systematic in nature to isolate certain exposures. Whether it's equal-weighted ETFs or single factor-based ETFs to gain exposure to dividends, value, momentum, etc., these investments typically are quant-based and don’t have a team of analysts doing bottom-up analysis.

The actual management may be mechanically passive, but it is certainly an active call, leaving it up to individual investors to decide which risk factors to get exposure to. In essence, these tools now make it easier than ever to unbundle a portfolio and allow investors to actively select which risk factors will be purchased. Systematic strategies can help enhance portfolios by providing a cost-effective option to gain specific exposures, but even if they use passive ETFs, these types of investments begin to lean more active.

Similarly, actively managed mutual funds that have a low active share and low turnover probably lie somewhere in the middle of the spectrum. You might be paying active management fees, but the returns will largely resemble benchmark returns less the fees. As new products continue to evolve, the lines between passive and active will continue to blur. Terms such as enhanced index construction or adding ESG considerations to market indexes are both examples of how product manufacturers can create something new with a bit of a tilt.

The active-passive experience

It is true that for the last decade, passive management has wildly outperformed active management in the large-cap U.S. market. But prior to that, the experience was not the same, and moving forward, we do not expect it to be either. The chart below is specific to US Equities in the Large Cap Blend category but has enough funds in the category to make the case for cyclicality. It is clear that in periods of economic uncertainty, active has the edge. From 2006-2011, active was the clear winner, and more recently, active has crept towards the upper percentiles as passive returns lower. As described above, there is an opportunity for active managers to outperform in more challenging markets.

But confirming our belief that passive and active is cyclical is the decade-long run of outperformance throughout the 2010s. It is not a coincidence that this outperformance overlaps with one of the greatest bull runs in US equity history. The 2010s was a decade pushed forward by a low rate, low inflation, and a highly accommodative monetary environment. This allowed growth equities to flourish, which is more represented in U.S. market cap indices. This decade run also produced some of the largest index concentrations we have seen. It also should not go unnoticed that the 2010s saw the creation of a majority of the passive index ETFs that exist today; we saw a massive migration of capital into these newly created products, which also pushed the performance higher. It was a consistent cycle of new capital, extension of a bull run, accommodative policy, and increasing concentration, resulting in outperformance of growth.

What this shows is that there is a case to be made for both active and passive in a portfolio. Having a mix of both management approaches sets your portfolio up for any unexpected environment. Rather than determining whether to be all active or all passive, higher on the scale of importance in portfolio construction is how the pieces of the portfolio complement each other. To achieve the goals set out for the portfolio, the components must work with each other and against each other to manifest strong portfolio diversification. Actively managing each piece of your portfolio is what is going to achieve success, not whether you chose an active equity mutual fund or a passive equity index ETF.

Final Thoughts

Breaking away from the active vs. passive debate is easy when thinking of asset allocation decisions from a portfolio perspective. In constructing and managing portfolios, you make active decisions, regardless of the solutions or products you choose to include. Whether you are adding U.S. exposure or tilting a portfolio more into growth, those are decisions you must actively make. Even if you use a passive investment, you still actively make that decision at the portfolio level.

Below is a checklist of sorts or specific areas to consider during the investment vehicle selection process for potential inclusion in a portfolio from the lens of active vs passive. This is not an exhaustive list:

As you can see, it is not only about active or passive. Ask yourself: what does an investment bring to the existing portfolio? Does it provide added exposure to a factor that you believe will benefit the portfolio given the macro market environment and outlook?

Whether to go active or passive, is much lower on the totem pole decision-making process. We have found complementing low-cost passive with active provides a much more diverse and resilient exposure in various asset classes from bonds to equities. As in many different areas of investing, there is no winner, simply building blocks for a portfolio.

Insights with Purpose

At Purpose, we are attempting to change the status quo within the investment industry. Mainly, the enigmatic standards by which the industry operates. We are an open book when it comes to portfolio design and discussions surrounding our outlook and strategies. We want to make managing portfolios simpler for advisors and act as a sounding board for ideas. We start by running portfolio comparisons between your portfolios and ours. Not to say ours is right and what you are doing is wrong, but to understand the differences and have discussions surrounding the rationales. We aim to keep this discussion going quarterly, this is not a one-and-done service. We want to build our relationships with advisors so that the end client has a satisfactory investment experience.

If you want to know what exposures your portfolio is tilted toward, feel free to reach out to our team. As the great Peter Lynch once said, “Know what you own and why you own it".

— Brett Gustafson is a Portfolio Analyst at Purpose Investments

— Craig Basinger is Chief Market Strategist at Purpose Investments

Past editions of Portfolios with a Purpose

Know what you own – Fixed Income

Factoring it in – considering factor exposures

Disclaimers

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Call our office today for a private consultation about your Beyond Wealth needs.

All Rights Reserved | Ottawa Wealth Management

Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. *Insurance Products provided through Chevron Preservation Inc.